(1) Download time series data from Yahoo Finance (example here is to download from 2011 up to 2013), or copy the url and download in browser and save as csv files

- getstockdata.sh Select all

curl "http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d" > msft.csv

curl "http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d" > aapl.csv

curl "http://ichart.finance.yahoo.com/table.csv?s=^IXIC&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d" > nasdaq.csv

curl "http://ichart.finance.yahoo.com/table.csv?s=GOOG&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d" > goog.csv

### or use wget "http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d" -O msft.csv

(2) Run script in R, you can use source("stocks.r")

- stocks.r Select all

msft <- read.csv("msft.csv")

aapl <- read.csv("aapl.csv")

goog <- read.csv("goog.csv")

nasdaq <- read.csv("nasdaq.csv")

stocks <- nasdaq[,c("Date","Close")]

colnames(stocks)[2] <- "NASDAQ"

stocks["MSFT"] <- NA

stocks$MSFT <- msft$Close

stocks["AAPL"] <- NA

stocks$AAPL <- aapl$Close

stocks["GOOG"] <- NA

stocks$GOOG <- goog$Close

(3) Do some analysis in R

- analysis.r Select all

### plot Data

plot(aapl$Date, aapl$Close)

cor(goog[c("Open")],aapl[c("Open")])

summary(stocks)

str(stocks)

pairs(stocks[-1])

cor(stocks[-1])

cov(stocks[-1])

eigen(cor(stocks[-1]))

### Do linear regression

mod1 <- lm(NASDAQ ~ MSFT + AAPL + GOOG, data=stocks)

summary(mod1)

?summary.lm

### Confidence Limits on the Estimated Coefficients

confint(mod1)

summary.aov(mod1)

### Prediction of mean response for cases like this...

predict(mod1, list(MSFT=30,AAPL=400,GOOG=800), interval="conf")

### Prediction for a single new case...

predict(mod1, list(MSFT=30,AAPL=400,GOOG=800), interval="pred")

mod2 = update(mod1,.~.-AAPL)

summary(mod2)

(prediction <- c(1,30,800) * coef(mod2))

sum(prediction)

### Compare two models

anova(mod1, mod2)

### Regression Diagnostics

par(mfrow=c(2,2)); plot(mod1); par(mfrow=c(1,1))

(4) Stepwise Regression in R

- stepwise.r Select all

###retrieve more stocks data directly using R as below

intc <- read.csv("http://ichart.finance.yahoo.com/table.csv?s=INTC&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d")

amzn <- read.csv("http://ichart.finance.yahoo.com/table.csv?s=AMZN&a=0&b=01&c=2011&d=11&e=31&f=2013&g=d")

###update model and do stepwise regression

stocks$INTC <- intc$Close

stocks$AMZN <- amzn$Close

mod3 <- lm(NASDAQ ~ MSFT + AAPL + GOOG + INTC + AMZN, data=stocks)

step(mod3, direction="both")

summary(mod3)

summary(step(mod3, direction="both"))

(5) Delta Normal VaR and ES for a single asset using R

Reference (VaR using Excel) : http://www.youtube.com/watch?v=ZrKmVC-Ede8

- DNVaR1.r Select all

# get the time series of AAPL with Closed Price

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=2&b=23&c=2012&d=2&e=23&f=2013&g=d");

# calculate log returns, note the -log sign below

aapl.logreturn = c(diff(-log(aapl$Close)));

# calculate VaR for 95% confidence interval, VaR is 0.03513197

qnorm(0.95)*sd(aapl.logreturn)-mean(aapl.logreturn);

#alternatively, qnorm(p=0.95, sd=sd(aapl.logreturn), mean=mean(aapl.logreturn));

# with a single asset of say $1M, the calculated Delta Normal VaR is $35,131.97

sprintf("%5.2f", 1e+06*(qnorm(0.95)*sd(aapl.logreturn)-mean(aapl.logreturn)));

#Expected Shortfall(ES) for Normal Distribution = $62,227.24

v <- qnorm(p=0.95, sd=sd(aapl.logreturn), mean=mean(aapl.logreturn))

tailExp <- integrate(function(x)

x * dnorm(x, mean=mean(aapl.logreturn),

sd=sd(aapl.logreturn)),

lower=-Inf, upper=v)$value / (1-0.95)

-tailExp * 1e+06

(6) Delta Normal VaR for a portfolio of assets using R

Reference (Portfolio VaRs using Excel) : https://www.youtube.com/watch?v=GqczSHRUaDk

- DNVaR2.r Select all

# get the time series of MSFT, GOOG, AAPL, ORCL and IBM

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

goog <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=GOOG&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

# calculate log returns from Closed Prices

msft.logreturn = c(diff(-log(msft$Close)));

goog.logreturn = c(diff(-log(goog$Close)));

aapl.logreturn = c(diff(-log(aapl$Close)));

orcl.logreturn = c(diff(-log(orcl$Close)));

ibm.logreturn = c(diff(-log(ibm$Close)));

# calculate the individual volatility

logreturns <- data.frame(msft.logreturn, goog.logreturn, aapl.logreturn, orcl.logreturn, ibm.logreturn);

sapply(logreturns,sd);

# calculate the individual VaR using Matrix and with position of $1M each using correlation matrix

VaR1 = (1e+06*sapply(logreturns,sd)) %*% cor(logreturns);

# calculate the Dollar Variance of the Portfolio

VaR2 = VaR1 %*% (1e+06*sapply(logreturns,sd));

# Square Root Portfolio Variance to calculate the Delta Normal 1-day Portfolio VaR for 95% confidence interval. The result is $119,605.5

qnorm(0.95) * sqrt(VaR2);

#Alternatively, the variance-cov method is demo here

v1 = cov(logreturns) %*% rep(1e+06,5);

v2 = rep(1e+06,5) %*% v1;

sqrt(v2)*qnorm(0.95);

# Portfolio VaR for 10 days

sqrt(v2)*qnorm(0.95)* sqrt(10);

(6.1) Delta Normal VaR and ES for a portfolio of assets using R

Using : simple return instead of log return

- DNVaR2.r Select all

# get the time series of MSFT, GOOG, AAPL, ORCL and IBM

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

yhoo <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=YHOO&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

# calculate simple returns from Closed Prices

#msft.simplereturn = -diff(msft$Close)/msft$Close[-length(msft$Close)];

#yhoo.simplereturn = -diff(yhoo$Close)/goog$Close[-length(yhoo$Close)];

#aapl.simplereturn = -diff(aapl$Close)/aapl$Close[-length(aapl$Close)];

#orcl.simplereturn = -diff(orcl$Close)/orcl$Close[-length(orcl$Close)];

#ibm.simplereturn = -diff(ibm$Close)/ibm$Close[-length(ibm$Close)];

msft.simplereturn = msft$Close[-nrow(msft)] / msft$Close[-1] -1;

yhoo.simplereturn = yhoo$Close[-nrow(yhoo)] / yhoo$Close[-1] -1;

aapl.simplereturn = aapl$Close[-nrow(aapl)] / aapl$Close[-1] -1;

orcl.simplereturn = orcl$Close[-nrow(orcl)] / orcl$Close[-1] -1;

ibm.simplereturn = ibm$Close[-nrow(ibm)] / ibm$Close[-1] -1;

# plot the histogram, assume different stock position

simplereturns <- data.frame(msft.simplereturn,yhoo.simplereturn,aapl.simplereturn,orcl.simplereturn,ibm.simplereturn);

hist(as.matrix(simplereturns) %*% c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05),col="green");

# calculate the individual volatility

simplereturns <- data.frame(msft.simplereturn, yhoo.simplereturn, aapl.simplereturn, orcl.simplereturn, ibm.simplereturn);

sapply(simplereturns,sd);

#using the variance-covariance method with different stock position to calculate VaR $35,473.23

v1 = cov(simplereturns) %*% c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05);

v2 = c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05) %*% v1;

sqrt(v2)*qnorm(0.95);

# Portfolio VaR for 10 days

sqrt(v2)*qnorm(0.95)* sqrt(10);

#calculate the ES $21,986.07

m <- sapply(simplereturns,mean) %*% c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05);

v <- qnorm(p=0.95, sd=sqrt(v2), mean=m);

- integrate(function(x)

x * dnorm(x, mean=m,

sd=sqrt(v2)),

lower=-Inf, upper=v)$value / (1-0.95)

# use PerformanceAnalytics to calculate VaR and ES

require(PerformanceAnalytics)

stockportfolio.ts <- as.xts(data.frame(msft$Close,yhoo$Close,aapl$Close,orcl$Close,ibm$Close), order.by = as.Date(msft$Date,"%Y-%m-%d"))

# calculate VaR $34,289.08

VaR(R = na.omit(Return.calculate(stockportfolio.ts, method="discrete")), p = 0.95, method = "gaussian", portfolio_method = "component", weights = c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05))

# calculate ES $43,300.71

ETL(R = na.omit(Return.calculate(stockportfolio.ts, method="discrete")), p = 0.95, method = "gaussian", portfolio_method = "component", weights = c(1e+06, 1e+05, 5e+03, 9e+04, 3e+05))

(7) Historical Simulation VaR for a single asset using R

Reference (Historical Simulation using Excel) : http://www.youtube.com/watch?v=6Nolb4-iRSI

- HSVaR1.r Select all

# get the time series of GOOG with Closed Price

goog <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=GOOG&a=1&b=25&c=2008&d=6&e=18&f=2008&g=d")

# calculate log returns, using natural log

goog.logreturn = c(diff(-log(goog$Close)));

# plot histogram

hist(goog.logreturn, breaks=seq(-.11,.19,by=.01), col="green");

#show the first 10 items in ascending order

head(sort(goog.logreturn),n=10);

# find volatility for 5% percentile, that is -4.10867%

quantile(goog.logreturn,0.05);

#Historical Simulation VaR for $1,000 is 4.10867

-quantile(goog.logreturn,0.05)*1000;

# find historical volatility for the 102 observations

sd(goog.logreturn)*sqrt(length(goog[,1]));

(7.1) Historical Simulation VaR for a single asset using R

Reference : Using the same data as per (5) above

- HSVaR11.r Select all

# get the time series of AAPL with Closed Price

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=2&b=23&c=2012&d=2&e=23&f=2013&g=d");

# calculate log returns, note the -log sign below

aapl.logreturn = c(diff(-log(aapl$Close)));

# calculate simple returns

aapl.simplereturn = aapl$Close[-nrow(aapl)] / aapl$Close[-1] -1;

# plot histogram and density curve

hist(aapl.logreturn,breaks=seq(-.15,.1,by=.02), col="green",freq=FALSE,main="Asset Returns", xlab="Return%",xlim=range(-0.15,0.1),ylim=range(0,28));lines(density(aapl.logreturn),col="red", lty="dotted",panel.last=abline(v=quantile(aapl.logreturn, 0.05), col="darkred",lwd=3)); mtext("95% C.I.",side=3,line=-3,adj=0.40,col="darkred");

#show the first 15 items in ascending order

head(sort(aapl.logreturn),n=15);

# find VaR for 5% percentile, volatility is 0.03205498 = $32,054.98

-quantile(aapl.logreturn,0.05)*1e+06;

# find VaR for 5% percentile, volatility is 0.03205498 = $31,546.66

-quantile(aapl.simplereturn,0.05)*1e+06;

# with a single asset of say $1M, the calculated Historical Simulation VaR is $32,054.98 comparing with the result of Delta Normal VaR of $35,131.97 as per (5) above

sprintf("%5.2f", 1e+06*-quantile(aapl.logreturn,0.05));

# calculate ES $46,965.9 for log returns

-mean(aapl.logreturn[aapl.logreturn <= quantile(aapl.logreturn, 0.05)])*1e+6;

# calculate ES $45,565.73 for simple returns

-mean(aapl.simplereturn[aapl.simplereturn <= quantile(aapl.simplereturn, 0.05)])*1e+6;

(7.2) Historical Simulation VaR for a single asset using R and Package PerformanceAnalytics

Reference : http://cran.at.r-project.org/web/packages/PerformanceAnalytics/

http://cran.r-project.org/web/packages/quantmod/

- HSVaR12.r Select all

#install.packages("PerformanceAnalytics");

require(PerformanceAnalytics)

# get the time series of AAPL with Closed Price

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=2&b=23&c=2012&d=2&e=23&f=2013&g=d");

# convert to time series

aapl.ts <- as.xts(aapl$Close, order.by = as.Date(aapl$Date,"%Y-%m-%d"));

# calculate VaR $32,054.98 for log returns

-VaR(Return.calculate(aapl.ts, method="log"),p=.95,method="historical") * 1e+06;

# calculate VaR $31,546.66 for simple returns

-VaR(Return.calculate(aapl.ts, method="discrete"),p=.95,method="historical") * 1e+06;

# calculate ES $46,965.9 for log returns

-ETL(Return.calculate(aapl.ts, method="log"),p=.95,method="historical") * 1e+06;

# calculate ES $45,565.73 for simple returns

-ETL(Return.calculate(aapl.ts, method="discrete"),p=.95,method="historical") * 1e+06;

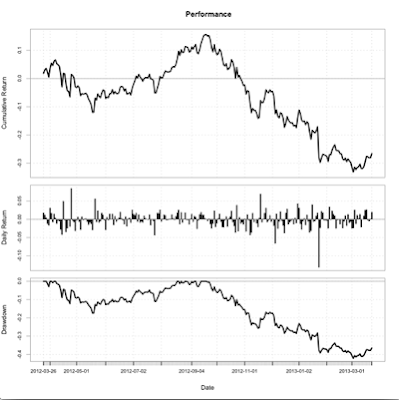

#plot PerformanceSummary using Package PerformanceAnalytics

charts.PerformanceSummary(Return.calculate(aapl.ts, method="log"));

#plot the time series chart using Package quantmod

#install.packages("quantmod");

require("quant mod");

chartSeries(aapl.ts, theme = chartTheme("white"), TA = c(addBBands(),addTA(RSI(aapl.ts))));

(7.3) Calculate VaR for a single asset using Monte carlo simulation: Brownian motion

Require : http://cran.at.r-project.org/web/packages/PerformanceAnalytics/

- MCVaR.r Select all

#install.packages("PerformanceAnalytics");

require(PerformanceAnalytics)

# get the time series of AAPL with Closed Price

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=2&b=23&c=2012&d=2&e=23&f=2013&g=d");

# convert to time series

aapl.ts <- as.xts(aapl$Close, order.by = as.Date(aapl$Date,"%Y-%m-%d"));

# calculate VaR $32,054.98 for log returns

-VaR(Return.calculate(aapl.ts, method="log"),p=.95,method="historical") * 1e+06;

# calculate VaR $3x,xxx (will print 3 iterations) using random 250 samples log returns generated based on sd and mean of AAPL

aapl.logreturn = c(diff(-log(aapl$Close)));

for (i in 1:3) {print (-VaR(as.xts(rnorm(250, sd=sd(aapl.logreturn), mean=mean(aapl.logreturn)),order.by=as.Date(aapl$Date,"%Y-%m-%d")),p=.95,method="historical") * 1e+06)};

# calculate VaR using random 1000 samples log returns generated based on sd and mean of AAPL

for (i in 1:3) {print (-VaR(as.xts(rnorm(1000, sd=sd(aapl.logreturn), mean=mean(aapl.logreturn)),order.by=as.Date(Sys.Date():(Sys.Date()+1000-1))),p=.95,method="historical") * 1e+06)};

# calculate VaR (will print 3 iterations) using random 250 samples log returns generated

# based on the assumptions of annual return drift=0.10 and annual return volatility=0.40

# daily volatility = annual volatility / sort(T)

# daily mean drift = annual drift/T - 0.5 * sd^2

# model reference from http://www.youtube.com/watch?v=e79OtCamxD0

for (i in 1:3) {print (-VaR(as.xts(rnorm(250, sd=0.40/sqrt(250), mean=(0.10/250)-0.5*((0.40/sqrt(250))^2)),order.by=as.Date(aapl$Date,"%Y-%m-%d")),p=.95,method="historical") * 1e+06)};

# calculate VaR (will print 3 iterations) using random 1000 samples log returns generated

# based on the assumptions of annual return drift=0.10 and a higher annual return volatility=0.60

for (i in 1:3) {print (-VaR(as.xts(rnorm(1000, sd=0.60/sqrt(250), mean=(0.10/250)-0.5*((0.60/sqrt(250))^2)),order.by=as.Date(Sys.Date():(Sys.Date()+1000-1))),p=.95,method="historical") * 1e+06)};

# plot the simulated prices from one instance of simulation

aapl.mc.logreturns = rnorm(1000, sd=0.60/sqrt(250), mean=(0.10/250)-0.5*((0.60/sqrt(250))^2));

plot(as.xts(c(1,exp(cumsum(aapl.mc.logreturns))) * tail(aapl$Close,n=1),order.by=as.Date(as.Date(c("2010-01-01")):(as.Date(c("2010-01-01"))+1000))),main="Simulated Price");

(8) Historical Simulation VaR for a portfolio of assets using R

Reference : Using the same data as per (6) Delta Normal VaR for a portfolio of assets

- HSVaR2.r Select all

# get the time series of MSFT, GOOG, AAPL, ORCL and IBM

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

goog <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=GOOG&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=5&b=14&c=2011&d=5&e=8&f=2012&g=d")

# calculate log returns from Closed Prices

msft.logreturn = c(diff(-log(msft$Close)));

goog.logreturn = c(diff(-log(goog$Close)));

aapl.logreturn = c(diff(-log(aapl$Close)));

orcl.logreturn = c(diff(-log(orcl$Close)));

ibm.logreturn = c(diff(-log(ibm$Close)));

# plot the histogram and density

logreturns <- data.frame(msft.logreturn, goog.logreturn, aapl.logreturn, orcl.logreturn, ibm.logreturn);

hist(as.matrix(logreturns) %*% rep(1e+06,5),col="green",freq=FALSE);

lines(density(as.matrix(logreturns) %*% rep(1e+06,5)),col="red")

# find VaR for 5% percentile, that is $109,409.9 and comparing with the result of Delta Normal VaR of $119,605.5 as per (6) above

-quantile(as.matrix(logreturns) %*% rep(1e+6,5), 0.05);

(8.1) Historical Simulation VaR and ES for a portfolio of assets using R

Using : simple return instead of log return

Calculate : Incremental VaR, Marginal VaR and Component VaR

- HSVaR250.r Select all

# get the time series of MSFT, YHOO, AAPL, ORCL and IBM for 251 trading days

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=3&b=3&c=2013&d=2&e=31&f=2014&g=d")

yhoo <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=YHOO&a=3&b=3&c=2013&d=2&e=31&f=2014&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=3&b=3&c=2013&d=2&e=31&f=2014&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=3&b=3&c=2013&d=2&e=31&f=2014&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=3&b=3&c=2013&d=2&e=31&f=2014&g=d")

# calculate simple returns from Closed Prices

msft.simplereturn = msft$Close[-nrow(msft)] / msft$Close[-1] -1;

yhoo.simplereturn = yhoo$Close[-nrow(yhoo)] / yhoo$Close[-1] -1;

aapl.simplereturn = aapl$Close[-nrow(aapl)] / aapl$Close[-1] -1;

orcl.simplereturn = orcl$Close[-nrow(orcl)] / orcl$Close[-1] -1;

ibm.simplereturn = ibm$Close[-nrow(ibm)] / ibm$Close[-1] -1;

# plot the histogram

simplereturns <- data.frame(msft.simplereturn,yhoo.simplereturn,aapl.simplereturn,orcl.simplereturn,ibm.simplereturn);

hist(as.matrix(simplereturns) %*% rep(1,5),col="green",freq=FALSE);

lines(density(as.matrix(simplereturns) %*% rep(1,5)),col="red");

# find VaR for 5% percentile, that is $71,726.65

-quantile(as.matrix(simplereturns) %*% rep(1e+6,5), 0.05);

# find Incremental VaR for each asset by removing each asset from the portfolio

# Incremental VaR : MSFT $3396.407; YHOO $19522.17; AAPL $10691.23; ORCL $12628.08; IBM $10749.8

Iport = matrix(1e+06, nrow=5, ncol=5);

diag(Iport)=0;

for (i in 1:5) {print(quantile(as.matrix(simplereturns) %*% (Iport)[i,], 0.05) -quantile(as.matrix(simplereturns) %*% rep(1e+6,5), 0.05))};

# Marginal VaR by list out the 13th element sort by portfolio return column

# msft.simplereturn yhoo.simplereturn aapl.simplereturn orcl.simplereturn ibm.simplereturn portfolio

#45 -0.02118989 -0.03323661 0.008112513 -0.01670709 -0.009686039 -0.07270712

returns <- data.frame(simplereturns, portfolio=as.matrix(simplereturns) %*% rep(1,5) )

tail(head(returns[order(returns$portfolio),],n=length(returns[,1])*0.05+1),n=1)

# Component VaR by multiplying Marginal VaR by the weight of each asset

# msft.simplereturn yhoo.simplereturn aapl.simplereturn orcl.simplereturn ibm.simplereturn portfolio

#45 -21189.89 -33236.61 8112.513 -16707.09 -9686.039 -72707.12

tail(head(returns[order(returns$portfolio),],n=250*0.05+1),n=1) * 1e+6

#find Expected Shortfall (ES) that is $103,035.5

m <- as.matrix(simplereturns) %*% rep(1e+6,5);

v <- quantile(m, 0.05);

-mean(m[m <= v]);

# plot all

hist(as.matrix(simplereturns) %*% rep(1,5),col="green",freq=FALSE,main="Portfolio Returns", xlab="Return%",xlim=range(-0.2,0.15),ylim=range(0,10));lines(density(as.matrix(simplereturns) %*% rep(1,5)),col="red", lty="dotted",panel.last=abline(v=quantile(as.matrix(simplereturns) %*% rep(1,5), 0.05), col="darkred",lwd=3)); mtext("95% C.I.",side=3,line=-3,adj=0.28,col="darkred");

#plot all plus superimposed normal distribution curve

xvals <- seq(from=-0.15, to=0.15,length=100)

hist(as.matrix(simplereturns) %*% rep(1,5),col="green",freq=FALSE,main="Portfolio Returns", xlab="Return%",xlim=range(-0.2,0.15),ylim=range(0,10));lines(density(as.matrix(simplereturns) %*% rep(1,5)),col="red", lty="dotted",panel.last=abline(v=quantile(as.matrix(simplereturns) %*% rep(1,5), 0.05), col="darkred",lwd=3)); mtext("95% C.I.",side=3,line=-3,adj=0.28,col="darkred");lines(xvals,dnorm(xvals,mean(as.matrix(simplereturns) %*% rep(1,5)),sd(as.vector(as.matrix(simplereturns) %*% rep(1,5)))),lwd=1,col="blue");

(8.2) Historical Simulation 10-Days VaR and ES for a portfolio of assets using R

Using : log return for 10 days and simple return for portfolio with 4 years historical data

- HSVaR10.r Select all

# get the time series of MSFT, YHOO, AAPL, ORCL and IBM for 260 trading days

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=2&b=20&c=2010&d=2&e=31&f=2014&g=d")

yhoo <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=YHOO&a=2&b=20&c=2010&d=2&e=31&f=2014&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=2&b=20&c=2010&d=2&e=31&f=2014&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=2&b=20&c=2010&d=2&e=31&f=2014&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=2&b=20&c=2010&d=2&e=31&f=2014&g=d")

# calculate log returns from Closed Prices and takes first 1000 samples only

msft.logreturn10 = c(diff(-log(msft$Close),10));

yhoo.logreturn10 = c(diff(-log(yhoo$Close),10));

aapl.logreturn10 = c(diff(-log(aapl$Close),10));

orcl.logreturn10 = c(diff(-log(orcl$Close),10));

ibm.logreturn10 = c(diff(-log(ibm$Close),10));

logreturns10 <- data.frame(msft.logreturn10, yhoo.logreturn10, aapl.logreturn10, orcl.logreturn10, ibm.logreturn10)[1:1000,];

# convert to simple returns

simplereturns10 <- (exp(logreturns10)-1)

# find VaR for 5% percentile for 10 days holding period, that is $259,314.5

-quantile(as.matrix(simplereturns10) %*% rep(1e+6,5), 0.05);

#find 10-Days expected Shortfall (ES) that is $343,451.5

m <- as.matrix(simplereturns10) %*% rep(1e+6,5);

v <- quantile(m, 0.05);

-mean(m[m <= v]);

# plot all

hist(as.matrix(simplereturns10) %*% rep(1,5),col="green",freq=FALSE,main="Portfolio Returns for Holding Period 10 days", xlab="Return%",xlim=range(-0.6,0.6),ylim=range(0,4));lines(density(as.matrix(simplereturns10) %*% rep(1,5)),col="red", lty="dotted",panel.last=abline(v=quantile(as.matrix(simplereturns10) %*% rep(1,5), 0.05), col="darkred",lwd=3)); mtext("95% C.I.",side=3,line=-3,adj=0.20,col="darkred");

#List the 51st item sort by portfolio return

#587 0.004545455 0.00523416 -0.002571286 -0.003148254 -0.01536958 -0.2592768

returns10 <- data.frame(simplereturns, portfolio=as.matrix(simplereturns10) %*% rep(1,5));

tail(head(returns10[order(returns10$portfolio),],n=length(returns10[,1])*0.05+1),n=1);

(8.3) Historical Simulation VaR and ES for a portfolio of assets using R and Package PerformanceAnalytics

Backtesting : if Actual Return < Theoretical VaR

constrOptim Ref : http://www.youtube.com/watch?v=MCvz-c6UUkw

- HSVaR21.r Select all

require(PerformanceAnalytics)

# get the time series of MSFT, YHOO, AAPL, ORCL and IBM

msft <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=MSFT&a=0&b=1&c=2012&d=2&e=31&f=2014&g=d")

yhoo <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=YHOO&a=0&b=1&c=2012&d=2&e=31&f=2014&g=d")

aapl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=AAPL&a=0&b=1&c=2012&d=2&e=31&f=2014&g=d")

orcl <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=ORCL&a=0&b=1&c=2012&d=2&e=31&f=2014&g=d")

ibm <-read.csv("http://ichart.finance.yahoo.com/table.csv?s=IBM&a=0&b=1&c=2012&d=2&e=31&f=2014&g=d")

stockportfolio.ts <- as.xts(data.frame(msft$Close,yhoo$Close,aapl$Close,orcl$Close,ibm$Close), order.by = as.Date(msft$Date,"%Y-%m-%d"))

# calculate VaR 0.0215341 0.01744393 0.02875233 0.02034777 0.01493424

-VaR(Return.calculate(stockportfolio.ts[1:251], method="discrete"),p=.95,method="historical")

# calculate ES 0.02622294 0.02608046 0.03779529 0.02482448 0.02314859

-ETL(Return.calculate(stockportfolio.ts[1:251], method="discrete"),p=.95,method="historical")

# Backtesting p=0.95 assuming equal weights

# i Actual Theoretical

# 2013-06-20 368 -0.128825 0.1031542

# 2013-06-21 369 -0.1229124 0.1039837

# 2013-07-19 388 -0.1754735 0.103187

# 2013-08-27 415 -0.1080645 0.1028595

# 2014-02-03 524 -0.1150287 0.1047768

for (i in 1:(nrow(stockportfolio.ts)-251)) {

actual <- sum(na.omit(Return.calculate(stockportfolio.ts[(251+i-1):(251+i)])));

theoretical <- sum(-VaR(Return.calculate(

stockportfolio.ts[(i):(251+i-1)],method="discrete"),p=.95,method="historical"));

if (any(actual < -theoretical)) {

print(cbind(stockportfolio.ts[(251+i),0],i=251+i,Actual=actual,Theoretical=theoretical))

}

}

# Backtesting p=0.99 assuming equal weights

# i Actual Theoretical

# 2013-07-19 388 -0.1754735 0.1667104

for (i in 1:(nrow(stockportfolio.ts)-251)) {

actual <- sum(na.omit(Return.calculate(stockportfolio.ts[(251+i-1):(251+i)])));

theoretical <- sum(-VaR(Return.calculate(

stockportfolio.ts[(i):(251+i-1)],method="discrete"),p=.99,method="historical"));

if (any(actual < -theoretical)) {

print(cbind(stockportfolio.ts[(251+i),0],i=251+i,Actual=actual,Theoretical=theoretical))

}

}

# Backtesting p=0.99 assuming weights of c(30,50,200,50,50)

# i Actual Theoretical

# 2013-01-24 266 -23.5823 13.22212

# 2014-01-28 520 -13.10302 12.38539

for (i in 1:(nrow(stockportfolio.ts)-251)) {

actual <- sum(na.omit(Return.calculate(stockportfolio.ts[(251+i-1):(251+i)])) * c(30,50,200,50,50));

theoretical <- sum(-VaR(Return.calculate(

stockportfolio.ts[(i):(251+i-1)],method="discrete"),p=.99,method="historical") * c(30,50,200,50,50));

if (any(actual < -theoretical)) {

print(cbind(stockportfolio.ts[(251+i),0],i=251+i,Actual=actual,Theoretical=theoretical))

}

}

# Use constraint optimisation to find the weight of each share of the portfolio

# optimise function g and to minimise VaR

portfolioVaR <- -VaR(Return.calculate(stockportfolio.ts[1:251], method="discrete"),p=.95,method="historical");

g <- function(x) {sum(portfolioVaR* x)};

# constraint matrix

A <- matrix(c(rep(1,5),rep(-1,5),diag(1,5),diag(-1,5)),nrow=2+5+5, ncol=5, byrow=TRUE);

# constraint values : value of portfolio = 500 and shareholding for each stock > 0 that is no short selling

b <- 500 * c(0.999999,-1.000-0.000001,rep(0.000001,5),rep(-1.000-0.000001,5));

# run constrOptim with initial value of 100 each

# $par = 0.1113882 58.9182990 0.4609939 78.1495814 362.3602354

# $value = 8.045164

constrOptim(theta=rep(100,5),grad=NULL,f=g,ui=A,ci=b)

# Backtesing again and plot the graph for Actual vs. Theoretical results based on the above optimised portfolio

# i Actual Theoretical

# 2013-04-19 325 -28.85769 12.51676

# 2013-10-17 451 -24.06681 13.6749

result.frame = data.frame()

for (i in 1:(nrow(stockportfolio.ts)-251)) {

actual <- sum(na.omit(Return.calculate(stockportfolio.ts[(251+i-1):(251+i)])) * c(0.1113882,58.9182990,0.4609939,78.1495814,362.3602354));

theoretical <- sum(-VaR(Return.calculate(

stockportfolio.ts[(i):(251+i-1)],method="discrete"),p=.99,method="historical") * c(0.1113882,58.9182990,0.4609939,78.1495814,362.3602354));

if (any(actual < -theoretical )) {

print(cbind(stockportfolio.ts[(251+i),0],i=251+i,Actual=actual,Theoretical=theoretical));

};

result.frame <- rbind(result.frame, data.frame(stockportfolio.ts[(251+i),],i=(251+i), Actual=actual,Theoretical=-theoretical));

}

result.zoo <- as.zoo(result.frame)

plot(x = result.zoo[,7:8], screens = 1, main="Actual vs. Theoretical VaR", xlab = "Time", ylab = "Return", col = c("darkgreen", "red")); legend(x = "bottomright", legend = c("Actual","Theoretical"),lty=1,col=c("darkgreen", "red"));

# revise the optimisation function to include portfolioLogReturn and to minimise risk / return ratio

#$par 1.177901 111.451867 142.695042 143.658599 101.017062

portfolioLogReturn <- colSums(Return.calculate(stockportfolio.ts[1:251], method="log"),na.rm=TRUE)

g1 <- function(x) {sum(portfolioVaR * x)/sum(portfolioLogReturn * x)};

A <- matrix(c(rep(1,5),rep(-1,5),diag(1,5),diag(-1,5)),nrow=2+5+5, ncol=5, byrow=TRUE);

b <- 500 * c(0.999999,-1.000-0.000001,rep(0.000001,5),rep(-1.000-0.000001,5));

constrOptim(theta=rep(100,5),grad=NULL,f=g1,ui=A,ci=b)

# rerun backtesting with portfolio weights = c(1.177901,111.451867,142.695042,143.658599,101.017062)

result.frame = data.frame()

for (i in 1:(nrow(stockportfolio.ts)-251)) {

actual <- sum(na.omit(Return.calculate(stockportfolio.ts[(251+i-1):(251+i)])) * c(1.177901,111.451867,142.695042,143.658599,101.017062));

theoretical <- sum(-VaR(Return.calculate(

stockportfolio.ts[(i):(251+i-1)],method="discrete"),p=.99,method="historical") * c(1.177901,111.451867,142.695042,143.658599,101.017062));

if (any(actual < -theoretical )) {

print(cbind(stockportfolio.ts[(251+i),0],i=251+i,Actual=actual,Theoretical=theoretical));

};

result.frame <- rbind(result.frame, data.frame(stockportfolio.ts[(251+i),],i=(251+i), Actual=actual,Theoretical=-theoretical));

}

result2.zoo <- as.zoo(result.frame)

plot(x = result2.zoo[,7:8], screens = 1, main="Actual vs. Theoretical VaR with optimised portfolio", xlab = "Time", ylab = "Return", col = c("darkgreen", "red")); legend(x = "topleft", legend = c("Actual","Theoretical"),lty=1,col=c("darkgreen", "red"));

There is one important difference between log return and simple return is that log return is time additive and simple return is portfolio additive. (Reference : http://www.youtube.com/watch?v=PtoUlt3V0CI)